How To Manage Money Wisely?

Do you know why everyone pushes themselves to the extreme just

to earn a bit more money? Simply, to live a healthy, wealthy, and financially

secured life! Thus, how you spend your

money is impactful on how you secure your future.

As spending money is an

art, you need to enhance your skills. You don't need to be a pro at

managing your personal finance or a massive investment portfolio to stay

monetarily secured! All you need is to understand the fundamentals of financial

planning.

Adopting these

following habits would help you manage your money wisely. So, let's begin

without further delay!

1. Make A

Budget Calendar

Your plan starts right

after you figure out the amount of money left after paying all your bills.

Start comprehending what your financial goals are! Do you want to travel or

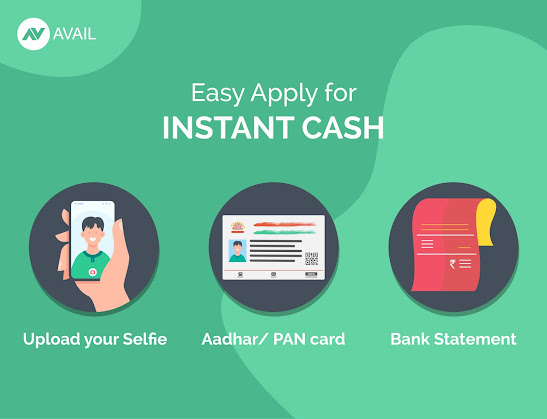

want to own a business? If yes, which loan app can you choose to fulfil these

aspirations?

All it requires is to

create a budget to accomplish your goals. Also, don't forget to stay focused on

your financial goals during your budgeting process!

2.

Differentiate Short-Term Savings From Long-Term Investments

Don't put yourself in a

scenario where you would depend on credit for an unrealistic expense! Saving

for emergencies should be your priority! Thus, save a minimum of three to five

months of living expenses.

When you plan for

larger purchases like a house or car, set up a separate bank account for them.

Saving for the short-term doesn't mean that you'd not consider your long-term

goals.

While considering

long-term, ensure that you invest in something better than a standard savings

account. Even if you are considering an instant

loan app, always ensure to pay the loan on time to prevent yourself

from taxing interests!

3. Using Your

Credit Card Wisely

Using your credit card

appropriately is crucial when it comes to managing your finances. After all,

your credit score will have a massive impact on the ability to invest in large

purchases. Also, ensure that you pay the bills timely and (if required)

periodically. Keep a decent balance below your card's limit.

Do not forget to pay

attention to the ratio of the amount of debt you have and the borrowing amount.

As per recommendations, it should be below 30 per cent!

4. Cut Down

On How Much You Treat Yourself

Nothing is as special

as a 'gift from you to you'! Although this concept is popular amongst

millennials today, how about reducing the expense on this front?

Yes, to manage your

financial status, cut down on the unnecessary expense you have for

yourself.

That counts on the

number of times you order café-made coffee, go out shopping just for no reason,

etc.! With your dedication and willpower, you'd be able to make it work for

your stable financial future.

5. Select A

Cost-Effective Mortgage Payment Or Rent

Housing costs are

higher than any other budget! As it's an emotional investment, the search for

an ideal home extends the budget beyond your comfort level. Thus, include the

fixed costs and set the housing budget. Also, consider the amount you can pay!

The best way you can

opt for a budget payment is by choosing a brilliant loan

app.

Always be realistic about your financial demands to avoid financial stress

later.

The Bottom Line

Money is vital for everyone as, without it, you cannot do

anything, and it takes a lot of hard work to earn a decent amount. If you are

finding it hard to manage your hard-earned money, the five tips mentioned above

will surely guide you through the process.

Comments

Post a Comment